Every vendor, from early to enterprise stage, must have a laser focus on SaaS cash management in order to survive. The lag times caused by the subscription payment model, PLUS the intense customer acquisition growth pressure in order to succeed in the market, makes cash burn tough to manage.

In SaaS, spending cash usually comes before receiving cash. And for growth companies, the cycle of selling faster than cash comes in the door can mean that they are cash flow negative even through $100M ARR. Most companies have to carefully nurture cash stocks in order to carry them through.

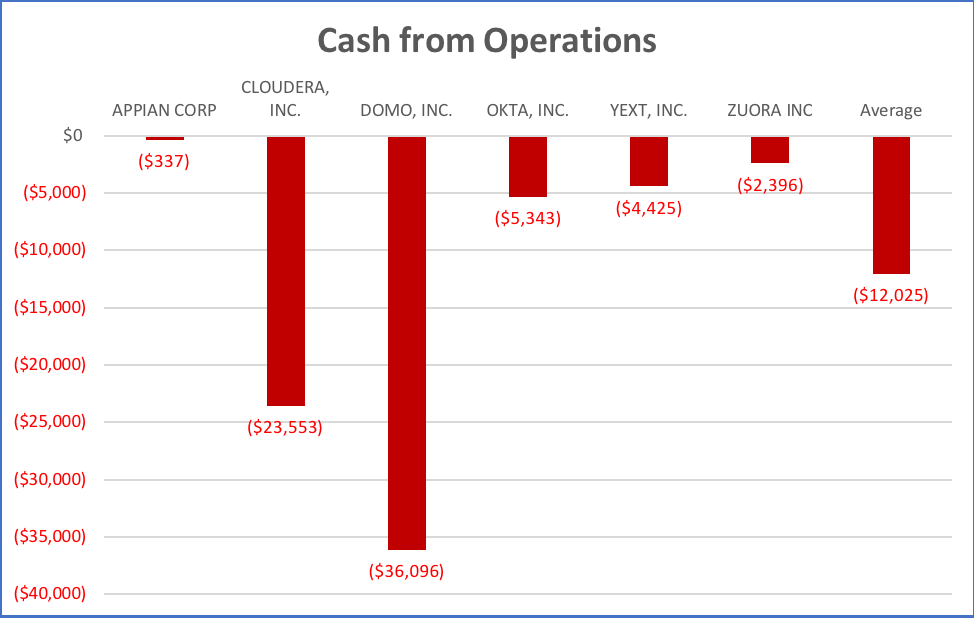

Looking at these recent IPO companies:

We see pretty big cash stocks:

Even though all these companies have scaled revenues past $100M ARR. All of them are in the red in terms of Cash from Operations:

SaaS Cash Management Basics

So, if this is tough stuff for public companies it is even tougher for private SaaS vendors. The first principle to keep in mind is that cash flow planning is not GAAP accounting. Sounds obvious, but too many companies have gotten caught with Finance focused on accounting for revenues and expenses, while cash is tight despite a decent looking P&L. Timing and the granularity of how you look at cash burn critical.Finance has to get really good at tracking and managing cash burn in real time AND put in place the right processes and assumptions to correctly forecast cash needs. Those cash forecasting processes and assumptions will also need to evolve as a company goes from $20M to $200M. Here’s a few tips:

1) Prepays are good and the longer the better. That’s why even companies selling small contracts to the SMB market generally offer a discount for a 12-month upfront prepayment. Enterprise contracts are almost always a minimum 12-month up-front payment, and sometimes for a longer term.

The downside of getting more than a 12-month up-front payment is that most customers then expect some kind of discount on the second and third year, if paid up front. Vendors have to look at whether the cash up front today is worth the discount on future revenues. A high retention rate and sticky product may make it worth foregoing longer term contracts if the probability of future renewals is high. If not, then the discount may be worth it. Probably something for Finance, not Sales, to decide, based on cash burn forecasting.

2) Month-to-month contracts have become less common in the B-2-B SaaS world, especially for vendors with Average Contract Values (ACV) over $3K. Month-to-month is more common in the SMB market.

3) Manage Accounts Receivable and DSO to 30 or 60 days – especially hard to do with large enterprise customers. Large enterprises like to drag out payment for months and 90+ days is common. DSO benchmarks for SaaS companies show the larger the ACV, the longer the DSO. Be on top of it and get your team to beat the benchmark.

Experience also shows that if the economy slows in the US, it will drag out accounts receivables, especially from large enterprises, so adjust cash forecasts accordingly if that happens in 2019.4) Forecasting when new investments will result in cash is tricky and will take longer than expected. A new round of funding allows the hiring of new sales people, but new sales people have to be on-boarded, trained, ramped, and then start selling. Once they sell, there will be a period before cash is collected. Few companies, especially early stage and growth stage companies, estimate correctly the length of time between receiving new investment and getting cash in the door, contributing to an unexpected change in cash burn.

Key Take-Aways:

Managing and forecasting cash burn and cash needs is a critical Finance function for SaaS companies. Some of the metrics that we see affecting changes to cash flow are:

- Changes (decreases or increases) in customer acquisition

- Changes in customer retention

- Changes to ACV (higher ACVs tend to extend DSO)

- New infusions of capital that may actually disrupt, in the short term, operations and cash flow as the organization adjusts to new hiring, new sales people, a new focus on product development, big changes to headquarters/offices/work environment, etc.

Tracking cash burn against benchmarks for peer companies at a similar stage with similar ACVs helps companies stay on top of the factors affecting cash burn. We can provide benchmarks for SaaS and software companies with revenues between $1M and $500M.